In the first part of this series, I discussed different aspects of expectancy and why it is important to understand expectancy to evaluate any trading system accurately. I finished with a link to a trading log, so you can understand how, as you’re filling your trades over time, you can understand your own system and setup expectancy.

Tracking your trades and understanding the math behind trading is the first critical step toward success. Mark Minervini said, "The truth of trading lies in the math. Probability, statistics, and risk management are the building blocks of successful trading. By understanding these concepts, we can make more informed decisions and trade with a scientific approach, rather than relying on emotions and opinions."

In step one, we learned about expectancy with the following formula:

Expectancy = (Avg Win * Win Rate) - (Avg Loss * Loss Rate)

Performance = Expectancy * Frequency

As we saw clearly, despite the importance of R ratios, the performance of a system is clearly more than just the profit/loss ratio. Once you start logging your trades and learning the “truth of your trading,” the next step is understanding how those numbers change as the market ebbs and flows.

Step 2: How does the market environment affect my odds of success?

In their zeal to “conquer the markets,” new traders want to find some magical indicator or pattern that continues to deliver, no matter the environment. In other words, they want to find a find fishing hole where the fish are always biting. Experienced fishermen focus on understanding the fish so they know the best time to fish, what bait to use to increase their chances, where to go to find the biggest fish, etc. Much like inexperienced fishermen waste a lot of time in fishing holes with no fish, it is in “understanding the fish” or, in our case, the market, where new traders can gain the most benefit but spend the least time.

Ivan Ivanhoff said, “As traders, we need to be aware of the current market environment and adjust our strategies accordingly. A trend-following approach may work well in a strong uptrend, but in a volatile or sideways market, a different approach may be necessary." Different market environments affect different aspects of the expectancy formula, and it is important to be aware of these dynamics.

Let’s start with the first part of the expectancy formula: (Avg Win * Win Rate)

Based on your trade tracking during the last uptrend, you managed a respectable 60% win rate with an average winning profit of $1,000. On the losing side, 40% and avg loss of $500. An expectancy of $400 - very good numbers, no doubt. Unbeknownst to you, we just entered a market correction. Instead of stocks going up on average, they started to drop week after week while you continued to plug away with your “high probability setups.”

Two things will happen: your average gain will shrink and your win rate will crater. While you were previously averaging $1,000 on wins with a 60% win rate, all of a sudden, your last 3 trades were losers. In fact, out of the last 10 trades, you’ve only managed to make any traction on 5-6 trades, but most quickly turned around and stopped you out. Not only that, while you were regularly hitting 2:1 and 3:1 reward-to-risk targets on the regular, (and sometimes getting 5:1 or 10:1) now, these targets rarely get hit, if ever. Your average gain on the last 10 trades plummets to $200.

The first part of your system’s positive expectancy is falling apart: your $1000 avg gain with a 60% win rate has shifted to a $200 gain with a 30% win rate.

What happens to the second part of the expectancy formula: (Avg Loss * Loss Rate)?

Well, being the diligent trader you are, you ALWAYS cut your losses short, because that’s the most important part of trading, right? So, your average loss doesn’t change that much necessarily. Your diligence in keeping your losses contained has served you well, so you keep your average loss at around $500. However, as noted before, your loss rate has jumped from 40% to 70% in the ensuing days and weeks.

The second part of your system expectancy is seemingly less affected: your $500 average loss stays the same, but your loss rate is 70%.

Expectancy = (Avg Win * Win Rate) - (Avg Loss * Loss Rate)

($200 * .30) - ($500 * .70) = -$260

Even though you religiously cut your losers short, just like you were taught, your once positive expectancy of $400 dramatically downshifted to -$260.

To make matters worse, during a bull market, you are almost always maxed out on equity - there are far more opportunities than you have capital, so you’re always sitting pretty close to zero cash reserves. This acts as an upper bumper of sorts. However, due to the recent market changes, you’re finding yourself with more cash than usual - fewer setups are breaking out, you’re getting stopped out more than usual, etc. So what do we do with this extra cash? We are looking for somewhere to deploy it, obviously.

This is another critical mistake traders make when conditions change and they start digging a hole - they dig deeper. This leads to the last part of the performance formula - frequency.

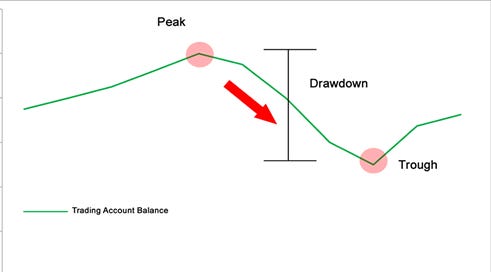

In many cases, frequent stop-outs lead to an INCREASE in the frequency of trading. Traders continue to look for trades, get stopped out, take another, then another. While they are trying desperately to get themselves out of the hole, they invariably make the hole much deeper. This leads to the “death spiral” of performance. A once manageable drawdown leads to larger and larger drawdowns as the trader attempts to “make something happen” to recover previous losses.

What to do?

To get out of the drawdown spiral, there are a few critical steps that traders need to take in changing market conditions:

Know what normal is. You MUST understand what is normal for your system during good times. This requires you to track your trades and your performance. If you don’t take the time to conduct this step, then you’ll never know the truth of your trading. Trading Log

Know the odds. My Market Breadth Monitor is a great place to start understanding whether we’re operating in what Mark Minervini dubs “an easy dollar market” or “a hard penny market”.

Recognize when things are changing. Your last 10 trades are a good “canary in the coal mine” of when your trading outcomes are deteriorating. When your stats start to change notably, this is a key indicator to take your foot off the gas.

Match setups to markets. Breakouts and pullbacks only really work well in an uptrending market environment and are much less reliable otherwise. Know which environments your setups work best in so you can adjust as needed.

Adjust your trading tactics. If you mostly trade bull patterns and the market environment turns bearish, don’t continue to trade these patterns. Your expectancy will go to shit. Either sit on your hands (preferred), trade much smaller, or switch to a setup that works in the new environment.

What’s next?

In Part 2 of this series, we focused on the impacts the market has on our expectancy and what to do when our expectancy starts to change.

In part 3, we will explore ways to determine which stocks have the most potential for the biggest moves in the market. This will include things such as relative strength, volatility, float, (some) fundamentals, and more.

Stay Tuned!!