Alright, continuing right along. The market backdrop is good and your “frisky buddies” have set up solid patterns with noice toit pivots. If you can’t say “That shit is toit, yo.”, then pass on it.

You’ve had a cluster of breakouts through the 1-2-3 pivot levels on strong volume and price expansion, and just like any disciplined trader, you’ve placed your stops using a low of the day, low of the pivot, or some volatility stop level below the pattern.

Next, we have to manage the trade. Like stop placement is a matter of balancing risk, reward, and temperament, the particular trade management strategy you employ needs to align with your personality for the most part and, perhaps, the market for some part. You have to consider what you think you want and what you can consistently do.

It doesn’t matter if you “want” to be a homerun trader - one who has a few giant wins that far more than make up for the losses - if you aren’t willing to be patient enough to sit with a trade while it trends for weeks and months. This style, especially with longer moving average trails, will have you sitting with a stock drawing down and going sideways for weeks and months, all while never violating its trail. This style will also routinely have you watch very decent initial gains roll over and stop you out at breakeven or even a loss in some cases.

It doesn’t matter if you “want” to be a more precise trader - one who has a much higher accuracy at getting lots of hits - if you continuously beat yourself up after taking your 2:1 or 3:1 and proceeding to watch the stock go 10:1 or more. While this “singles and doubles” kind of style works well, in a strong uptrend, you can also miss out on some monster stock moves that the trailing style of management lives for.

So you have to ask yourself, what kind of trader do you want to be? Just like in a marriage, if you want to be true to your partner (your system), you must understand their beauty and flaws and love both as part of the package. If you tell your wife you love her, but have a sneaky link on the side, then you’re not being honest with your wife or yourself and things aren’t going to work well. In the same way, if you don’t accept a style that works for you, you’ll always be looking across at the other methods, feeling like you’re missing something when in reality, you just never actually chose what style you want to marry. You thought you could see a few girls at once, and somehow, it would all work out.

Step 5.3 Position Management Tactics

While there are many position management strategies, I’ll discuss a few of the most common ones, starting with the most aggressive to the most relaxed. Just like there are trade-offs with stop placement, there are certainly tradeoffs with position management strategies. Certain things, like the market environment and the volatility of a stock, can strongly affect the outcomes of different management methods. Also, if a stock’s character changes during the unfolding of a move, the strategy used can also change.

Bar by Bar - just as it sounds, you trail the lows of each bar. If you started at the lows of day 1, at the end of day 2, you move the stop to the lows of day 2. This method has variations whereby you can use the lowest low of the last 2 or 3 bars and trail as long as the stop holds.

Target All or Nothing - once your profits reach some multiple of your risk, you sell the entire position. Most traders use a 2:1 or 3:1 profit target. Once in a trade, one of two things happen - your target or your stop is hit. This is one of the easiest trade management strategies since you can bracket the entry above and below and then wait.

Pivot Trail - if you think about point 3 in the 1-2-3 pattern, as your stock makes higher highs and higher lows, point 3 will continue to move higher. Stops remain as the most recent pivot lows and only move after a new pivot is formed.

Moving Average Trail - stops are trailed using a moving average. Various moving averages can be used, but common ones are the 8, 10, 21, and 50-day trailing moving averages. Imagine a 30-week moving average like Stan Weinstein suggests - holy shitballs, that’s a long time. It’s about knowing the tradeoffs with each. Typically once a stock has breached the moving average, positions are closed, either the same day or some traders wait the next day to see if the lows of the breach hold or not.

Combination - most top traders I’ve studied use a combination of the above. Maybe they trade like Kris, sell a portion after a certain number of days, and then trail the rest with a moving average. Maybe they have a bigger target like 3 or 4 to 1, and basically “squeeze” the stock between a trail and the target - once in motion, either the stock will hit the target or it will hit the trail. Perhaps they use a 2:1 all or nothing, but if neither the target nor the stop has been hit after X number of days, they close the position.

The only way to really know what works best for you is to use one method consistently while tracking the other options over the same period. This will give you the truest indication of which method worked the best during that timeframe.

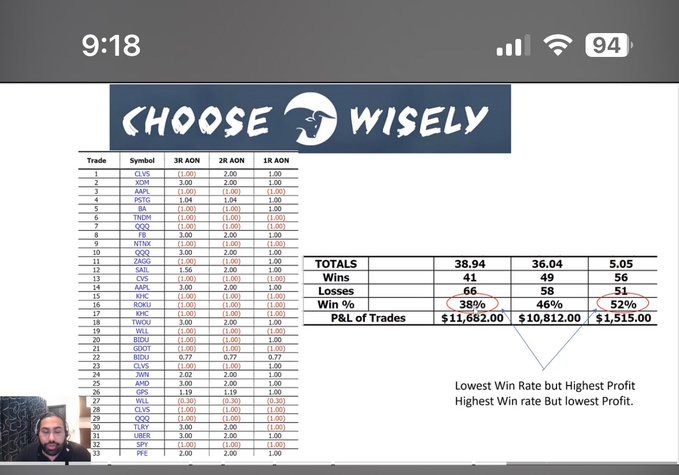

As Anmol from Live Traders points out in this course, a trader tracking 1:1, 2:1, and 3:1 discovers that by using a 3:1 all or nothing targets, he generated almost 10 times the profits of a 1:1, despite 1:1 having a higher batting average. He also notes that the 2:1 did generate slightly fewer profits but an 8% higher batting average. If you like higher accuracy based on your personality, you’ll sometimes sacrifice some profits to gain some sanity points from less churn. Tracking various management methods is a good way to know, cycle by cycle, how things are playing out - based on the numbers, not based on how you feel.

Which one is the best?

Looking at the above examples, it’s easy to conclude that profit targets are useless, and trailing with a pivot or moving average is the way to go. I picked FSLY 0.00%↑ for a reason - we were in the middle of a rip-roaring bull move, and this stock was a big winner then. During trending markets, using profit targets can cause you to leave a lot of money on the table potentially, and you'll never catch a big trend - ever.

However, another factor is capital turnover. If you can keep cranking out 2 and 3 to 1 profits over and over again (which is very possible in a healthy broad-based rally), you can actually compound your money faster than if you, say, trail the 50-day moving average while increasing your hold time by weeks. What’s easier to get - seven 10% gains? Or one 100% gain?

I don’t know about you, but I get 10% gains all the time, but I can only count a small handful of 100%+ gains I’ve managed to hold correctly. However, they both end up to about the same return. How long would it take you to make the 10% gains vs making a 100% gain? That extra hold time comes with an opportunity cost. If your capital is locked up in a name for weeks at a time, it cannot be deployed into new ideas.

Also, in choppy or difficult markets, 2:1 targets are much easier to hit regularly. In contrast, if you were trailing with a pivot or moving average, you’ll often see a 2:1 paper profit rollover and go to zero. However, if you always take profits at 2:1, you’ll never get a 30, 50, or 100% winner - ever. That’s just part of game. You have to pick your poison. What’s more important to you - higher accuracy and turnover, but possibly missing a decent trend? Or, potentially making “life-changing money” with a big monster trend but dealing with extra volatility and hold time in the process.

I am not trying to persuade you one way or the other. I’m merely trying to get you to understand that everything in trading comes with trade-offs. To do one thing means to deny another, and you have to understand what you gain vs what you lose. If you are patient and want to be relatively inactive, trailing with longer-term moving averages can keep you in a winner for months and possibly years. There are some stocks, in the course of hundreds or thousands of percent gain, never once violated their 200-day moving average. Many successful long-term investors use this as a good running trail.

I, for one, do not have the patience for that. I know myself. I can barely stand using the 10-day moving average, let alone the 50 or 200. Whenever I have “tried” to use a longer-term moving average, I sabotage it a week or two later and move my stops up. I’ve tended toward slightly higher turnover and lower hold time management methods. I don’t sell same-day, but I don’t usually hold something for months on end. I’m more of an intermediate-term swing trader, holding things for maybe two weeks to two months, depending on how the stock unfolds in its action.

I also tend to vary my strategy based on the market environment. Mark Minervini talks about setting stop losses as a function of expected gain. Rather than thinking about just the loss side relative to the expected gain, I took this concept one step further and also use it for determining my trailing strategy. When the market is shit, my expected gain is smaller, so why would I use longer-term trailing methods when the market likely won’t produce outsized gains? If the market is good, my expected gain is much higher, so why would I choke trades off prematurely, rather than letting them trend and unfold?

If the market is healthy and things are working well, I tend to use trailing methods. If the market is more difficult, I tend to move towards 2:1 method since I know I can hit those targets easier and generate some income. Also, depending on volatility, I might move from a moving average trail to a bar-by-bar, especially if the stock looks like it’s going parabolic e.g. it’s getting very stretched away from its moving averages and having a blow-off kind of move. If a stock blows off and you’re waiting for the trail to hit, you’ll likely lose 30-50% of whatever profit you had. At the same time, this one is easy to fuck up, as some of the most climactic moves can keep going much further than you can imagine.

Practical Application

Once in a trade, place your stops every trade, without exception. Do not, I repeat, do not ever move your stops WIDER than the initial stop level. Stops always move up, never down.

Manage the trade based on your plan. Every method has trade-offs, but you need to pick something. If you can’t chose, pick a combination of one short-term and one long-term method. For example, sell a portion after 3-5 days, and trail the rest with the 20-day MA or sell a portion at a 2:1 target and trail the rest with the 10-day MA. This way, you scratch both itches.

If conditions are poor, either don’t trade or aim towards shorter hold times and smaller targets. If conditions are good, aim towards either longer hold times methods or higher turnover (to take advantage of compounding) methods.

If conditions change while in the middle of a trade, consider adjusting. For example, if you are using longer hold-time methods because the market is good, but then suddenly the market conditions deteriorate, it is ok to become more defensive and crank stops up using a shorter-term method. If you were using the 50-day, maybe you move to the 10-day, or if you were using the 10-day, you start trailing bar by bar. Likewise, if the mkt has been sucking and you were using 2:1 targets, but things improve, consider taking a longer-term management approach, at least while the market is good. It’ll help you hold things while they are trending nicely.

These are just recommendations, but you must figure this out yourself. Trading is not a binary activity with robotic choices unless you have one of those black-box mechanical systems. As a discretionary trader, you have to use your discretion - you have to weigh the environment and weigh the trade-offs. You’ll screw this up many times. That’s ok. Over time you’ll learn which methods work better than others, knowing you’re using your method because you trust it and have tested it. That way, when you round trip $AI, like I did, you at least can make yourself feel better that it was part of your plan instead of crying over the spilled milk.

What’s Next

In this installment, we discussed position management strategies and some considerations and implications for each. This isn’t an all-encompassing treatise on position management. This is to get the juices flowing and get you thinking. At the end of the day, it’s your capital. You need to pick something that works and understand there are tradeoffs to whatever you pick. You won’t get this perfect, I assure you.

In part 6, we’ll be discussing Risk Management - probably one of the most important topics of all.

Stay Tuned!!

Waiting for part 6

Hi, Thank you for great summing up of trading. Is the part 6 released ?