Top Trader Profile: Dan Zanger

Dan Zanger is a highly successful trader who has achieved incredible returns by primarily focusing on technical analysis. He holds a world record for his trading one-year stock market portfolio appreciation, gaining over 29,000%. In under two years, he turned $10,775 into $18 million and ultimately amassed over $42 million in just a few years from that original stake. Fortune magazine wrote an extensive article on Zanger, covering his trading results after reviewing his IRS tax returns and trading records. He has made a name for himself as one of the top traders in the world and has shared his insights in numerous interviews and articles. Zanger's trading approach is centered around a few fundamental principles that he believes are key to successful trading.

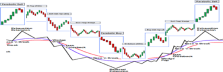

One of the main principles that Zanger emphasizes is the importance of technical analysis. He believes charts and other technical indicators can help traders identify trends and patterns leading to profitable trades. As Zanger puts it, "I've always believed that technical analysis is a better indicator of what's going on in the stock market than any other form of analysis."

Zanger's technical analysis approach focuses on identifying specific chart patterns and using them to make trades. He pays close attention to the relative strength of individual stocks and looks for opportunities to buy when he sees an uptrend forming. Zanger also uses technical indicators like moving averages and trendlines to confirm his analysis and help him make more accurate predictions.

Another key principle that Zanger emphasizes is the importance of patience and discipline in trading. He advises traders to wait for the right opportunities and not to make impulsive trades. Zanger knows that jumping into a trade based on emotion or FOMO can be tempting, but he believes this approach is not sustainable in the long run. As he puts it, "You have to be patient and disciplined. If you don't have those qualities, you won't be successful."

Zanger's approach to risk management is also central to his success as a trader. He advises traders to use stop-loss orders to limit their losses and to take profits when the market is in their favor. Zanger believes that managing risk effectively is crucial to long-term success in trading. As he puts it, "You have to have a good risk management system. You can't be right all the time, so you need to limit your losses when you're wrong."

Zanger also emphasizes the importance of constantly learning and adapting to changing market conditions. He believes that the market is always evolving, and traders need to be willing to change their approach if they want to stay ahead of the game. Zanger advises traders to stay up-to-date on market news and trends and to be willing to change their approach if necessary. As he puts it, "You have to be willing to learn and adapt. The market is always changing, and you need to change with it if you want to be successful."

Finally, Zanger believes that controlling emotions is crucial to successful trading. He advises traders not to let fear or greed drive their decisions and to remain level-headed and objective. Zanger knows that emotions can cloud judgment and lead to bad trading decisions. He says, "You can't let emotions get in the way of your trading decisions. Fear and greed are the two biggest emotions that will destroy your account. You need to be able to control them and make rational decisions."

Dan Zanger achieved incredible returns by focusing on technical analysis, patience and discipline, risk management, continuous learning, and controlling emotions. He believes these principles are key to long-term success in trading and advises aspiring traders to incorporate them into their own approach. As he puts it, "Trading is a challenging business, but if you're patient, disciplined, and have a good risk management system, you can succeed. Always be learning and adapting, and don't let emotions get in the way of your decisions."

You can learn more about Dan and his strategies at https://chartpattern.com/dan-media.cfm. I’m not affiliated with him or his site - he’s just a solid trader with a lot of experience.